Abstract: With the advent of Ethereum spot ETFs, is there a more “foolproof” on-chain ETF investment option available?

On July 23, according to official information from the SEC, several S-1 applications from ETF issuers have been formally approved, allowing Ethereum spot ETFs to be listed for trading. Initial trading is expected to begin tomorrow (Tuesday morning U.S. time).

Imagine if any ordinary investor could complete the investment transaction process for a crypto asset ETF in one step on the blockchain through simple NFT minting or token swapping. Wouldn’t that be fantastic?

This is exactly what Haya is doing.

It’s widely known that since October 2023, spot Bitcoin ETFs have become one of the core narratives driving the current market rebound. Especially after the U.S. Securities and Exchange Commission (SEC) officially allowed Ethereum spot ETFs to be traded on July 23, market sentiment was reignited, and the secondary market saw a flurry of activity.

However, in reality, crypto ETFs have deterred many ordinary investors who wish to gain exposure to crypto assets. The high entry barriers, exorbitant fees, complex transaction processes, and the fact that only Bitcoin and Ethereum are available as mainstream options leave out broader and potentially higher-growth assets.

Yet, it is within this awkward situation that Haya has keenly identified an incremental market demand. Haya is dedicated to creating a more user-friendly, convenient, and low-threshold on-chain crypto ETF investment environment, allowing more ordinary investors to participate in crypto asset investments and share in the market’s growth dividends.

The Booming Trend of Crypto ETF Investments

First, let’s understand that ETFs, as “open-end funds that track market indices and can be freely traded on stock exchanges,” do not require users to have deep knowledge of specific assets. Instead, users rely on their understanding of market trends to achieve diversified industry or market exposure through a basket of assets.

In other words, ETFs not only allow users to profit from individual stock transactions but also enable them to gain returns from a basket of thematic stocks, achieving the so-called “vague correctness”—gaining nearly Beta-like industry net growth returns and sharing in the overall growth dividends of the crypto market.

However, currently, whether in the U.S. or Hong Kong, the influential ETFs launched in the crypto world are centered around Bitcoin and Ethereum, with no index-type crypto ETFs available.

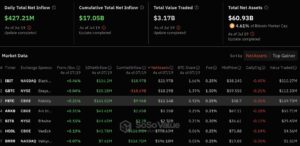

According to SoSoValue data, as of July 22, 2024, the total net asset value of the 11 U.S. Bitcoin ETFs exceeds $60 billion, with an ETF net asset ratio (market cap to Bitcoin total market cap ratio) of 4.61%, and historical cumulative net inflows exceeding $17 billion, continuing to set new records.

Meanwhile, the total AUM of the six Hong Kong virtual asset spot ETFs exceeds $350 million. Among them, Bitcoin spot ETFs hold nearly 5,000 BTC, with a total net asset value of $317 million; Ethereum spot ETFs hold nearly 13,000 ETH, with a total net asset value of $44 million.

In terms of development speed, the U.S. Bitcoin spot ETFs’ $60 billion scale can be considered a “lightning achievement” reached in about half a year, fully demonstrating the market’s, especially off-market incremental users’, absolute enthusiasm for crypto assets. As the most eye-catching emerging asset class, cryptocurrencies like Bitcoin have long made billions of traditional investment users and dormant funds eager to get involved.

However, as mentioned earlier, traditional crypto ETFs, although a “timely rain,” are still insufficient. High entry barriers, exorbitant fees, complex transaction processes, and the inability to include broader and potentially higher-growth assets like BNB, SOL, and TON still deter many ordinary investors who wish to gain exposure to crypto assets.

Given the current abundance of on-chain crypto asset categories and quantities, whether reflecting traditional financial development logic or considering realistic crypto investment needs, it is increasingly important and necessary to have on-chain ETF forms of crypto investment portfolios targeting different asset categories and sector directions.

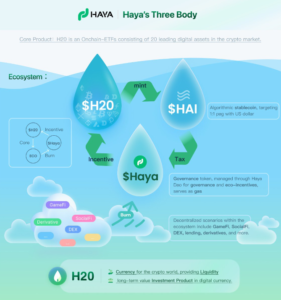

Haya, positioned as a “decentralized crypto bank for digital residents,” is precisely targeting this area, aiming to provide ETF-form crypto investment products on-chain to simplify the entry barriers for investors into the crypto market, helping users easily share in the long-term, stable, and efficient growth dividends of the crypto market.

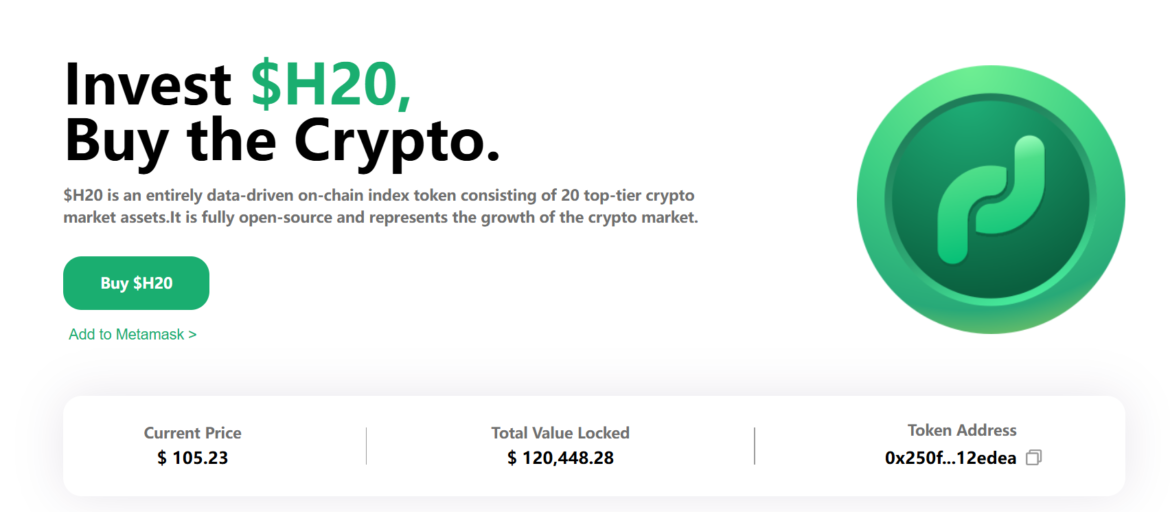

Haya’s H20: The First Index-Type On-Chain TF Product

Haya’s currently launched H20 is also the first index-type on-chain ETF product. It is supported by a basket of crypto assets (20 component tokens) and can be subscribed and redeemed at any time. Users can track the performance of high-quality tokens in specific blockchain fields through subscription, transaction, and redemption operations of the ETF product, achieving diversified investment purposes.

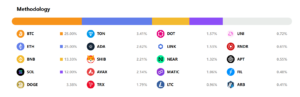

The selection of the 20 component tokens that make up this index-type ETF follows a rigorous screening process:

- The 20 component tokens are selected based on their circulating market cap and 90-day cumulative trading volume to ensure they represent the most important and actively traded assets in the market.

- Specific weights are determined by market cap and adjusted based on circulating supply and trading volume, with a maximum weight cap of 25% for a single component token to prevent over-concentration.

- Additionally, the index is rebalanced quarterly to reflect changes in market conditions, ensuring it still represents the current crypto landscape, with the component list and weights adjusted based on the latest data.

As of now, the first batch of 20 component tokens includes BTC, ETH, BNB, SOL, DOGE, TON, ADA, SHIB, AVAX, TRX, DOT, LINK, NEAR, MATIC, LTC, UNI, RNDR, APT, FIL, and ARB.

Bitcoin and Ethereum each account for 25%, accumulating to half of the weight, ensuring the index has a Beta as an anchor while sharing the Alpha dividends of the other 18 tokens.

According to historical backtest data, the overall net value of H20 perfectly matches the cyclical trend of the crypto industry, not only far exceeding the overall performance of the S&P during the same period but also outperforming the returns of holding only BTC.

It is worth noting that the base date of the index is May 19, 2024, with a base point of 100. As of July 21, the latest net value is 105.23, achieving a return of over 5% in just two months.

H20’s Dividend Participation

Currently, H20 is the first index-type on-chain ETF product launched by Haya. Subsequently, Haya will launch multiple crypto-themed ETFs based on the weights of high-quality assets in different fields.

Haya has already partnered with Singaporean ETF service provider Enlighten Tech, which is responsible for the global compliance issuance of crypto ETFs. Enlighten Tech is applying for compliant ETF products in collaboration with Malaysian financial institutions. Additionally, ongoing markets include other Southeast Asian countries, the Middle East, Brazil, Europe, and North America.

Furthermore, H20 will become a key component of the broader Haya ecosystem (index fund H20, stablecoin HAI, DeFi platform Haya), with functions including but not limited to: serving as over-collateralized assets for HAI issuance, participating in liquidity mining LP to earn yields, transaction fees/liquidation fees and other fee rights, etc.

Since H20’s smart contract is deployed on Arbitrum, assets on the Arbitrum chain (such as USDT, USDC, ETH, and WETH) can be used to obtain H20 shares.

Users holding ETF assets through H20 on-chain mainly have two forms (both with zero fees).

The first is minting: Users can directly convert a basket of tokens into corresponding ETF shares (in token form) through smart contracts. For example, according to the current index token component weights, on the “Mint” page of the official website, users can enter the desired ETF shares of H20 and automatically calculate the required quantities of the component tokens.

As long as the linked wallet contains the necessary quantities of the 20 corresponding tokens, H20 ETF shares can be minted:

- Users input the number of ETF shares they want to purchase, and Haya automatically calculates the quantities of each component token.

- Minting, which deducts the corresponding quantities of component tokens from the user’s wallet to the smart contract.

- The smart contract transfers the user’s component tokens to the fund pool held by the contract.

- Triggering the minting contract function, which transfers the corresponding ETF shares to the user.

The other way is more straightforward: buying—users purchase already minted ETF shares (in token form) from other minters or holders through DEX.

The logic for redemption is the reverse of minting in both forms, allowing users to freely combine assets, enabling anyone to create crypto ETFs and accept user funds.

Conclusion

The market always tends to overestimate the short-term effects of new things while underestimating their long-term impact.

Reflecting on the on-chain world, the diversity, operability, and programmability of the Web3 ecosystem mean that DeFi products have long been stacking like Lego blocks, creating innovative and diverse financial products. This implies a dazzling learning cost and investment threshold for an increasing number of crypto incremental users.

Meanwhile, crypto ETFs listed on traditional securities markets like Nasdaq are essentially traditional securities transactions. Compared to the blockchain world, where transactions are continuous 24/7 and innovation iterates rapidly, the creation and trading of combinations still lag behind.

Therefore, helping crypto users freely create investment portfolios for new public chains, DeFi tracks, or more segmented scenarios on-chain, while directly conducting immediate and simple multi-exposure asset allocation, is a crucial issue the crypto world needs to seriously consider for incremental users.

Thus, a decentralized ETF platform like Haya’s H20, which more professionally meets these needs and tries to provide straightforward asset allocation services for specific tracks or segmented directions directly on-chain, deserves continuous attention.

Media Contact:

email: [email protected]