U.S. bond yields, which are viewed by the market as risk-free bonds, have risen and DeFi yields have fallen, causing the crypto market boom to fade and the total locked-in value (TVL) of DeFi to fall rapidly by more than 70% from a high of nearly $180 billion in December 2021 to $48.9 billion as of May 6.

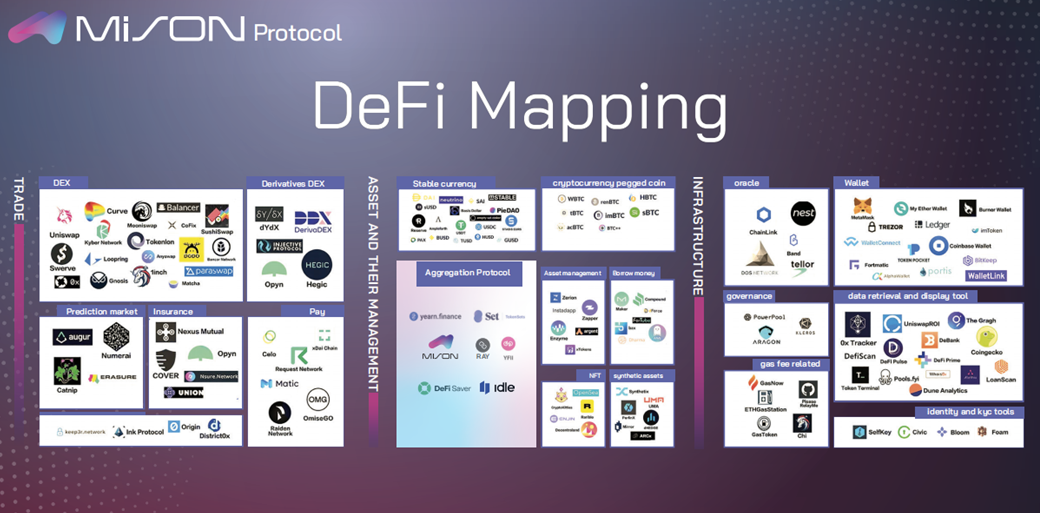

As market uncertainty increases, DeFi investors increasingly need a diversified portfolio of assets to achieve stable returns unrelated to cryptocurrencies. And at this time, MiSon brings a whole new opportunity for DeFi investors. Through blockchain technology, DeFi investors seeking high returns can access DEX spot liquidity arbitrage and lending protocol liquidity arbitrage, thus making it easier to participate in global financial markets.

MiSon increases the utilization rate of capital by directly addressing the pain points of the industry

For a long time, decentralized finance has preferred to link all community members who may provide liquidity, using liquidity incentives as the entry point to bind users to incentive relationships in all future transactions, and devoting to building a decentralized financial architecture that is warm, sustainable and interconnected.

Guided by these expectations, MiSon aims to build a complete decentralized financial ecosystem and constructs a decentralized smart contract liquidity aggregation service protocol based on the Ethernet blockchain financial infrastructure and smart contract protocols. Users can enjoy fully transparent transactions and the ability to hold their preferred assets through the MiSon smart contract protocol that has gone live, ensuring secure ownership and management of their assets at the time of investment and other financial infrastructure services.

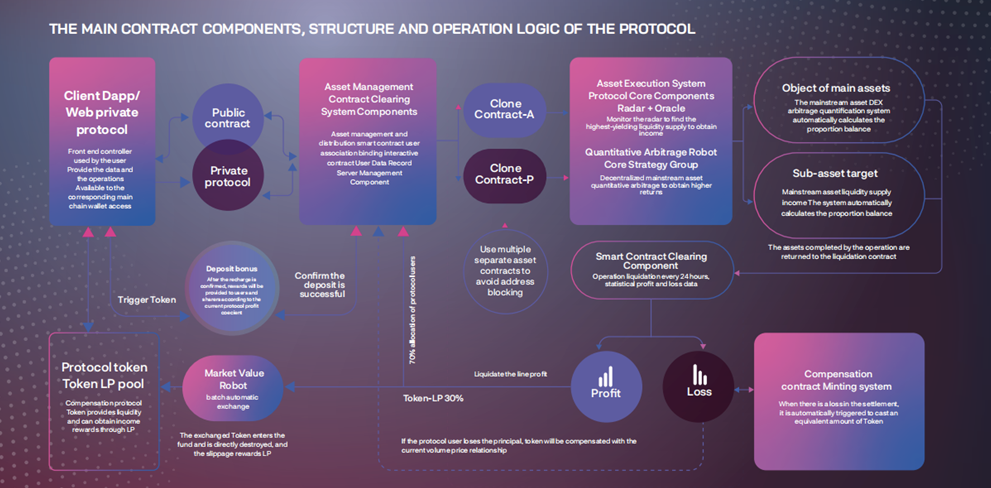

In terms of technology application, MiSon hits the pain points of the industry, combining the complex operation, increased threshold and poor user experience of traditional DeFi, and the “quantitative strategy component” will automatically calculate the parameters to ensure a balance of return and risk, and in principle, activate the automatic quantitative arbitrage program to automatically capture arbitrage opportunities to obtain No-loss profit. The solution is powered by smart contract components + AI artificial intelligence, revolutionizing the way people access, manage and protect their digital assets, improving the efficiency of capital use and thus achieving excess returns.

Automate the transaction and settlement process to complete value capture

Smart contracts facilitate profit farming, a process by which users are rewarded for providing liquidity or participating in various DeFi protocols. MiSon handles the distribution of rewards based on user contributions.

MiSon uses a double helix mechanism, divided into two parts: the product side and the asset side. 30% of the product side goes to the asset side for repurchase and destruction when the protocol generates profit, so MiSon’s economic model is a super-deflationary model.

In DeFi, liquidity is the biggest productivity. MiSon lending liquidity arbitrage is through decentralized lending protocols such as AAVE, Compound, etc. and ensures market depth and reliability of liquidity.

Smart contracts play a key role in the decentralized finance (DeFi) ecosystem by enabling trustless, automated and transparent financial services. They are the backbone of various DeFi applications as they provide the programmability and security necessary to create decentralized financial products. MiSon completes the value capture in the DeFI track through algorithmic models, profit aggregators and various smart contract components to create excess profit for users.

MiSon automates the trading and settlement process, thus simplifying trading and reducing transaction costs. By using AI smart modules, smart contract components and AI algorithms that are highly compatible with different dimensions of the market, it makes trading easier, efficient and smart, enabling easy management of your digital assets. This helps to increase the efficiency of using funds while simplifying its complexity.

In addition, lending and transactions in DeFi involve risks, and MiSon can minimize risks and improve returns by comprehensively assessing project risks and measuring the commissioning ratio through the prophecy machine + radar. Meanwhile, MiSon innovatively designed and developed the “Minting Compensation protocol” as an inferior solution, allowing deposit users to avoid the force majeure risks arising from the liquidation process.

protocol upgrade with 30%+ combined profit

In February 2023, MiSon protocol upgraded version 2.0, adding the lending protocol arbitrage, adding the lossless insurance policy coin protocol, the protocol profit generation will consist of: lending protocol iquidity liquidity arbitrage With DEX+Ai order flow arbitrage, the comprehensive profit will be effectively increased by 30%.

Despite the challenges and uncertainties in the DeFi market, MiSon remains a very promising investment option that can provide investors with diversified and stable investment returns. As the technology continues to advance and the regulatory environment becomes clearer, MiSon will further mature and develop.