Imagine you’ve been tracking Bitcoin all day. It suddenly drops 5% in ten minutes. Your first instinct would be to sell before it falls further. Minutes later, the price bounces back, and you’re left regretting the panic move. Or maybe you bought into a token because it was trending on social media – only to watch it lose steam right after you entered.

If this situation sounds familiar, you’re not alone. Almost every trader has felt the sting of emotional decisions – fear pushing you out too early, or greed pulling you in too late. In a market as fast as crypto, emotions or following market hype can become your biggest enemy.

That’s why more traders are leaning on algo trading to keep their decisions steady. In this blog, we’ll discuss how a cryptocurrency exchange like Delta Exchange helps you in making mindful trading decisions.

Why Emotions Can Be a Downside in Crypto Trading

Trading isn’t just about numbers – it’s also about how you react under pressure. And let’s face it, crypto tests patience like no other market. Emotional trading often shows up in a few common ways:

- Chasing hype and buying coins because everyone else is talking about them.

- Panic selling at the first sign of red candles.

- Placing more trades than planned, hoping to recover losses.

- Ignoring risk by adding too much leverage because it feels right.

The problem? These choices rarely match your original plan. Over time, emotions cut deeper into your profits than market volatility itself.

How Algo Trading Helps in Disciplined Crypto Trading

Algo trading or algorithmic trading is simply about turning your rules into instructions that the system can execute for you. Instead of reacting in the heat of the moment, you set conditions in advance, and trades run automatically.

To begin with, you can start with Delta Exchange’s algo trading bots to automate your crypto derivatives trades.

If you’re wondering why algo trading is in demand today, it’s because:

- Your rules stay consistent. No second-guessing mid-trade.

- Execution is instant. No delays caused by hesitation.

- Markets run 24/7. Your strategy doesn’t miss out when you’re asleep.

- Emotions don’t interfere. Algorithms don’t care about hype or fear.

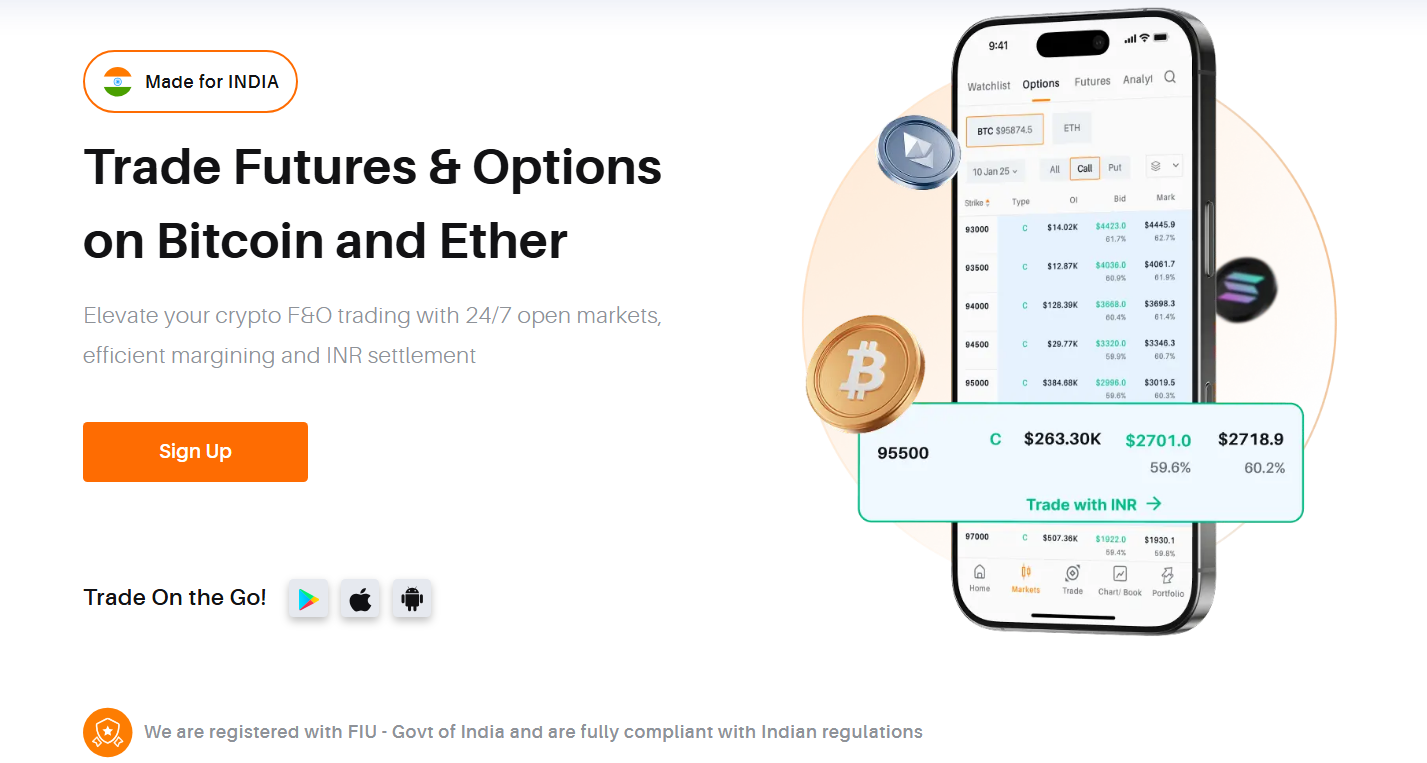

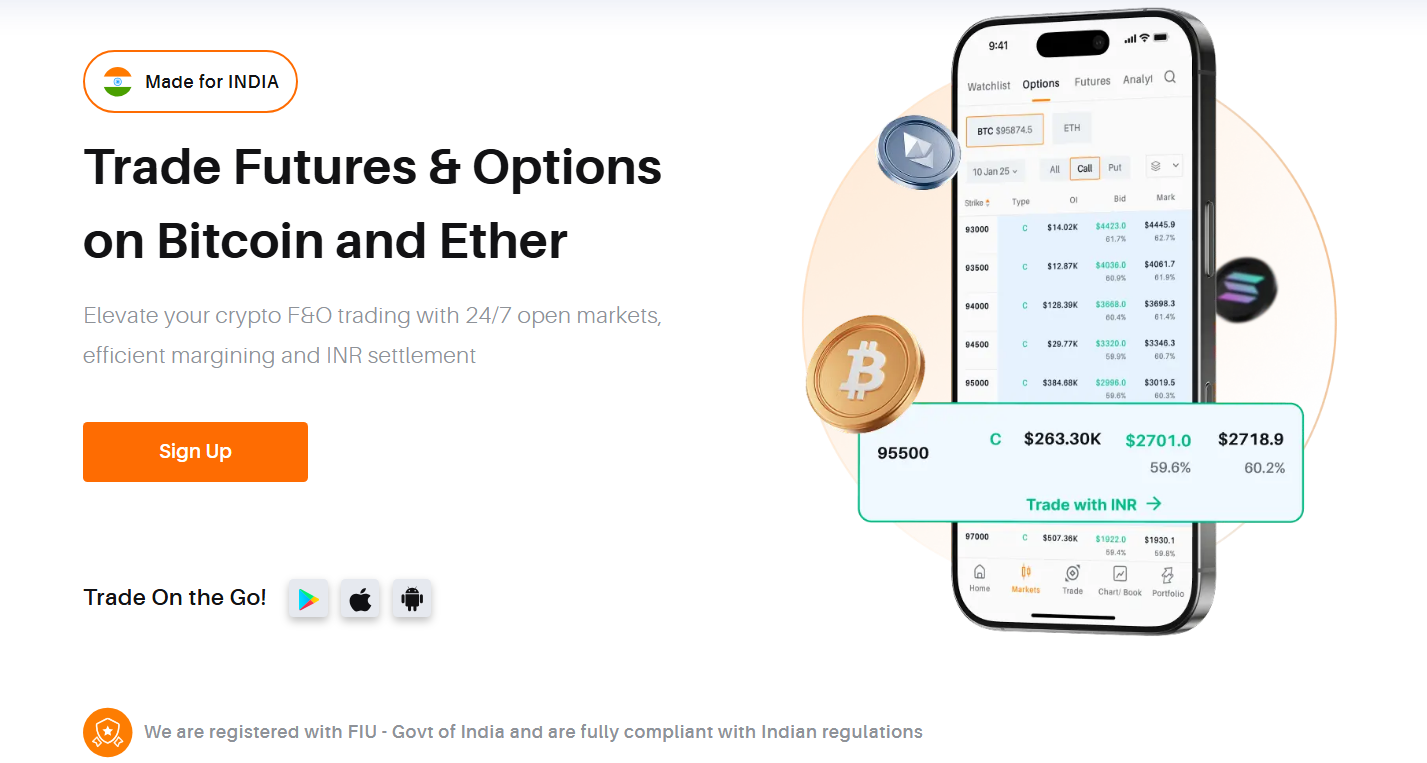

Why Delta Exchange Makes Algo Trading Simple

Many traders think that algo trading is out of reach unless they’re professional coders. Delta Exchange breaks that myth by making automation simple, practical, and accessible.

Delta Exchange’s algo trading for crypto traders

Here’s what sets it apart:

- Low trading fees: Delta offers lower trading fees compared to many other cryptocurrency exchanges in the market.

- Fast onboarding: No complex account setup – you can get it done within minutes and start exploring the market quickly.

- Deep liquidity: Your trades fill closer to expected prices.

- Wide product choice: From crypto futures and options to Trackers on Delta.

- Risk control tools: Demo accounts, small lot sizes, and payoff charts so you can test before scaling up.

And then there’s API Copilot, Delta’s AI-powered assistant built directly for algo traders:

- Works like a chatbot to answer API-related questions in plain language.

- Generates Python code snippets instantly for tasks like placing market orders or connecting via WebSocket.

- Debugs errors such as “invalid API key” and offers fixes on the spot.

- Lets you describe a trading strategy and receive working code you can test.

Delta Exchange simplifies crypto derivatives trading with API Copilot

With API Copilot, algo trading on Delta doesn’t feel technical – you get real help, real-time. Whether you’re a beginner or advanced trader, this cryptoccurrrency exchange gives you space to focus on strategy instead of sentiment.

Best Practices to Follow

Even with automation, you’re still in charge of setting the rules. To really get the benefit of algo trading on Delta Exchange, keep these habits in mind:

- Start small: Begin with small lot sizes before scaling strategies. On Delta, BTC contracts start from ₹5,000 and ETH at ₹2,500.

- Backtest your plan: Run it on past market data to check effectiveness.

- Avoid constant interference: Trust the algo – don’t override it every time you feel emotions taking over.

- Watch leverage: Delta offers up to 200x leverage – while they are good for maximising gains in crypto derivatives trading, they carry equal risks if the market moves against you.

- Use demo account: Delta’s demo account provides an insight into the live market without real funds.

Final Thoughts

Every trader has a story about an emotional decision that cost them profits. But the good news is, you don’t have to keep repeating the cycle. Algo trading helps you stick to your plan, cut out impulsive mistakes, and keep your head clear.

With features like API Copilot, deep liquidity, and a wide range of crypto derivatives contracts, Delta Exchange gives you the tools to put that discipline into practice. If you’ve been looking for a way to trade smarter and stress less, algo trading on Delta could be the step that finally keeps emotions from calling the shots.

To start testing crypto derivatives trading and automation, visit www.delta.exchange and join the community on X for the latest updates.